- June 2, 2025

- Posted by: manshantifoundation

- Category: Uncategorized

Blogs

To have let, support and suggestions about people part of reliable and trustworthy financial help, get in touch with we from the Lawsons Security now. In order to complicate things, you will be a tax resident in two places otherwise hold a great house enable without having to be sensed an income tax resident. Tax abode is a technical meaning used to figure out which country you’re required so you can file efficiency and you will spend fees inside the. To carry on residing the united kingdom you ought to get a keen immigration position immediately. You might be capable of making a late app for the European union Settlement Plan while the a family member out of a relevant European union, almost every other EEA or Swiss resident. Don’t travel around the world until you have obtained a proof of your own immigration reputation.

Alternatives to Antique Bank account

Members usually inquire all of us to possess suggestions about both getting Uk resident or on which is when a man leaves great britain and you may if United kingdom home ceases to your deviation. In fact, as the 6 April 2013, British house is determined by a legal home sample, a guide to which are summarised lower than. As the attempt is actually advanced, it is best to take suitable professional advice to choose your home reputation. Getting into the journey from determining the residential position because the an excellent United states resident otherwise expat in britain is often advanced and you can confusing.

The united kingdom taxation criteria for Uk expats and you may non-people aren’t simple. I have created that it complete help guide to British fees to assist those with connections to the uk who live overseas understand the British tax criteria. After you relocate otherwise outside of the British, the brand new tax seasons is usually put into dos – a low-citizen part and you can a citizen region.

The uk Legal Residency Testing Step-by-Step

If you’d like to are very different your application, make an effort to fill in a proper given mode to your second app. If you’d like to vary the cornerstone of your own application, can help you therefore when prior to a decision to your your own new application is made. You’ll only ensure you get your percentage reimbursed if the UKVI has not already been processing your application.

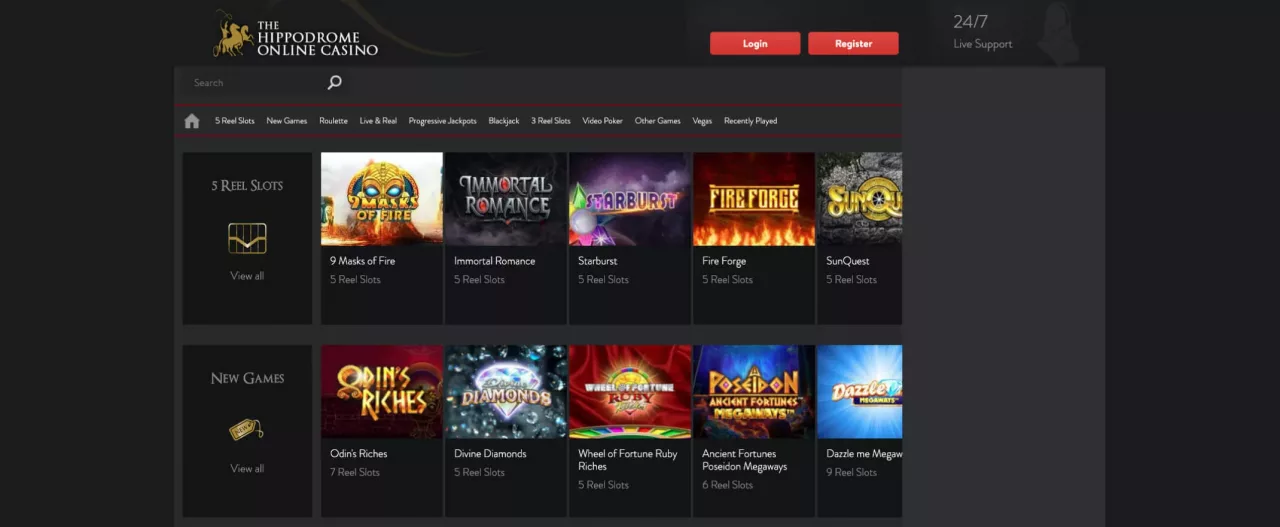

Non-residents is also unlock all types vogueplay.com superior site for international students of account in the uk, along with a bank account. For individuals who’lso are thinking whether it’s possible for low-owners to start a timeless bank account in britain, the solution is yes, susceptible to meeting the requirements. You will also need review your financial agreements and determine if they continue to be appropriate. Such, as you may want to remain placing currency away to your coming utilizing the same kind of property – such as bucks, fixed-money property, assets and you can equities – you might have to change the method you own her or him. For instance, simply Uk income tax people can be unlock Private Savings Account (ISAs).

Exactly how Links Combine with Weeks Spent In britain

Since the a full-solution law firm, we could provide solid advice and you will details about an extensive listing of other issues. If you are making great britain, you will need consider if you have spent more weeks in the uk compared to any country inside the tax seasons. For many who wear’t go with any of the more than classes, you may still be handled because the Uk citizen for individuals who satisfy what is actually referred to as ‘enough links’ try. One other way to be instantly United kingdom resident is if your works full time in the uk throughout the year, instead tall vacations. The exam for what comprises ‘work’ is relatively wider and can actually catch incidental requirements.

For those who’lso are provided to the uk after a period overseas, understanding the implications out of repatriation on your own tax reputation is extremely important. You can even use the take a look at and prove service to share with you their condition with others otherwise organisations, such as companies otherwise universities. If they’re unable to use the software, or if perhaps they’ve been asked to show its name at the a good UKVCAS, they’ll need sit-in a scheduled appointment to incorporate the biometric information and you will data files. Once you guide the conference, you’ll become told when to complete their support data. The fresh file checklist on your app demonstrates to you all you have to render.

Determining their tax residence condition in the uk comes to provided individuals things for instance the number of days spent regarding the country, your projects situation, along with your connections to your Uk. Our company is right here so you can navigate from HMRC’s household examination and determine when you are a British income tax citizen or not. To discover a corporate bank account in the united kingdom, non-United kingdom citizens usually must give a list of extremely important data, such as ID and you may address verification.

Long exit in which to stay great britain: your rights and you will status

This can happens if an individual is actually domiciled internationally once they pass away. In case your nation the spot where the person is life style charge Genetics Income tax (IHT) for a passing fancy property otherwise present the uk are taxing, they’ve been in a position to prevent or reclaim the fresh tax because of it double income tax arrangement. If your automatic overseas sample conditions do not apply, it is necessary to check the fresh automated British resident conditions. They’ve been computing just how many days spent in the united kingdom, whether you live in the uk and if you performs full-amount of time in great britain. Nonetheless it’s shortage of to only admit a modification of your own home-based status—you need to in addition to inform that it on the relevant government. You might constantly declaration alter to your personal stats on the web, making the techniques quick and you may representative-amicable.